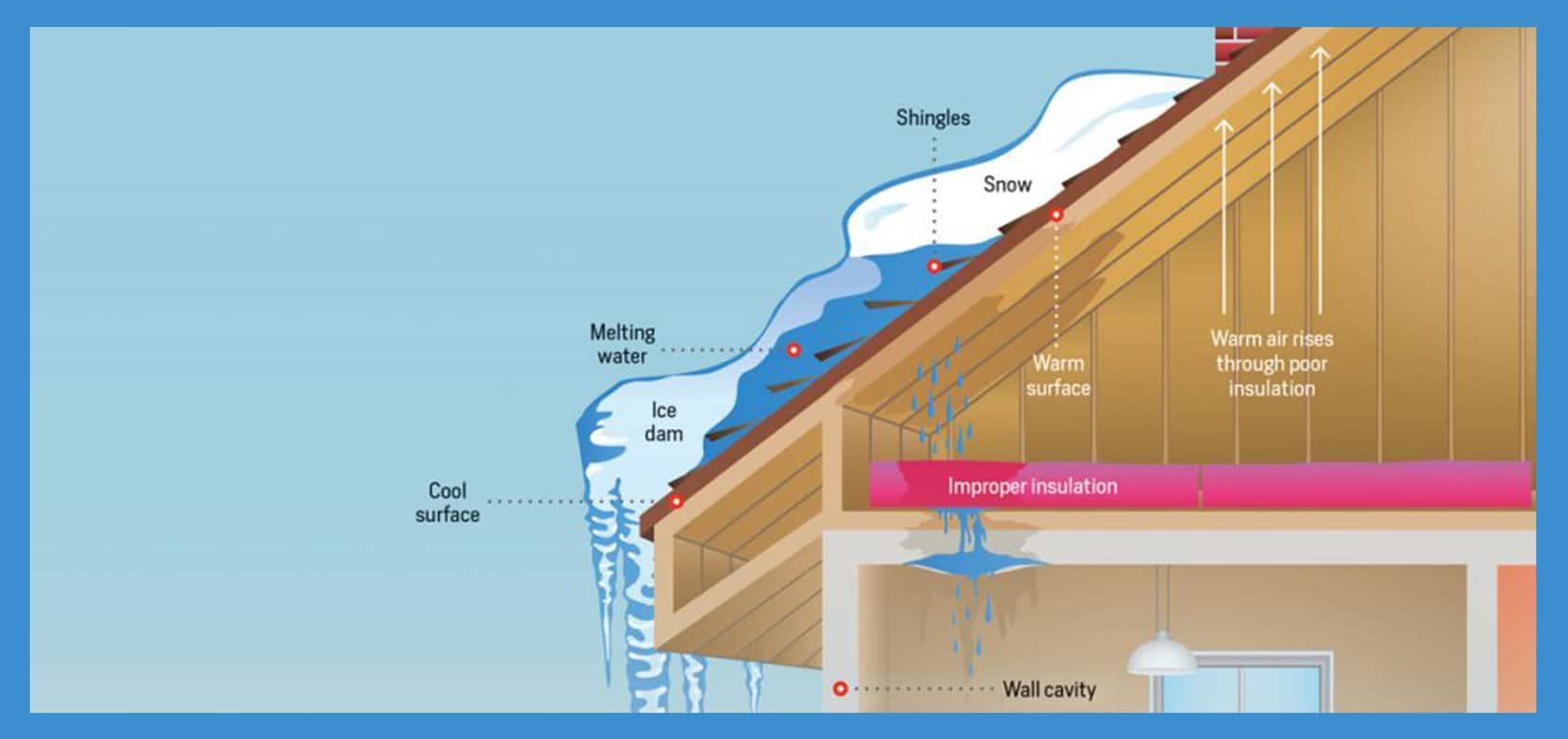

For areas of the country that deal with bitter cold, snow and ice can bring unwelcomed damage to your home. An example of such damage are ice dams which are ridges of ice that form when heat inside your home enters the attic and melts snow on the roof.

As the snow melts and drips down the roof, it refreezes and leads to a buildup of ice and a backup of water, which is where the term “dam” comes in.

Ice dams can not only cause falling ice (which can be fatal), but water can cause damage to the roof and shingles as well as to your home’s ceiling and walls. Water leaks can also damage wall insulation and increase the odds for mold.

So how do you prevent ice dams?

- Make sure your attic is properly insulated and sealed

- Allow heat to easily escape from your home (gable vents, ridge vents, soffit venting)

- Install a roof leak barrier under your roof shingles to block water from leaking into vulnerable areas

- Keep all rain gutters, drains, downspouts, and scuppers free from debris

- Maintain trees and plants growing near your roof to prevent accumulation that may clog or slow roof drainage

- Get an audit done of your home to identify potential areas of concern

- Remove the first three to four feet of snow from the roofline with a roof rake or soft bristled broom

- Make sure the ladder is secure

- Beware of falling snow and ice as you clear the roof

- If the home is too high to reach, hire a roofing professional to clear the snow

If you do happen to have an ice dam claim, the MAPFRE Property Department is always available to answer questions and offer assistance. You can file a claim at any time online with MAPFRE.