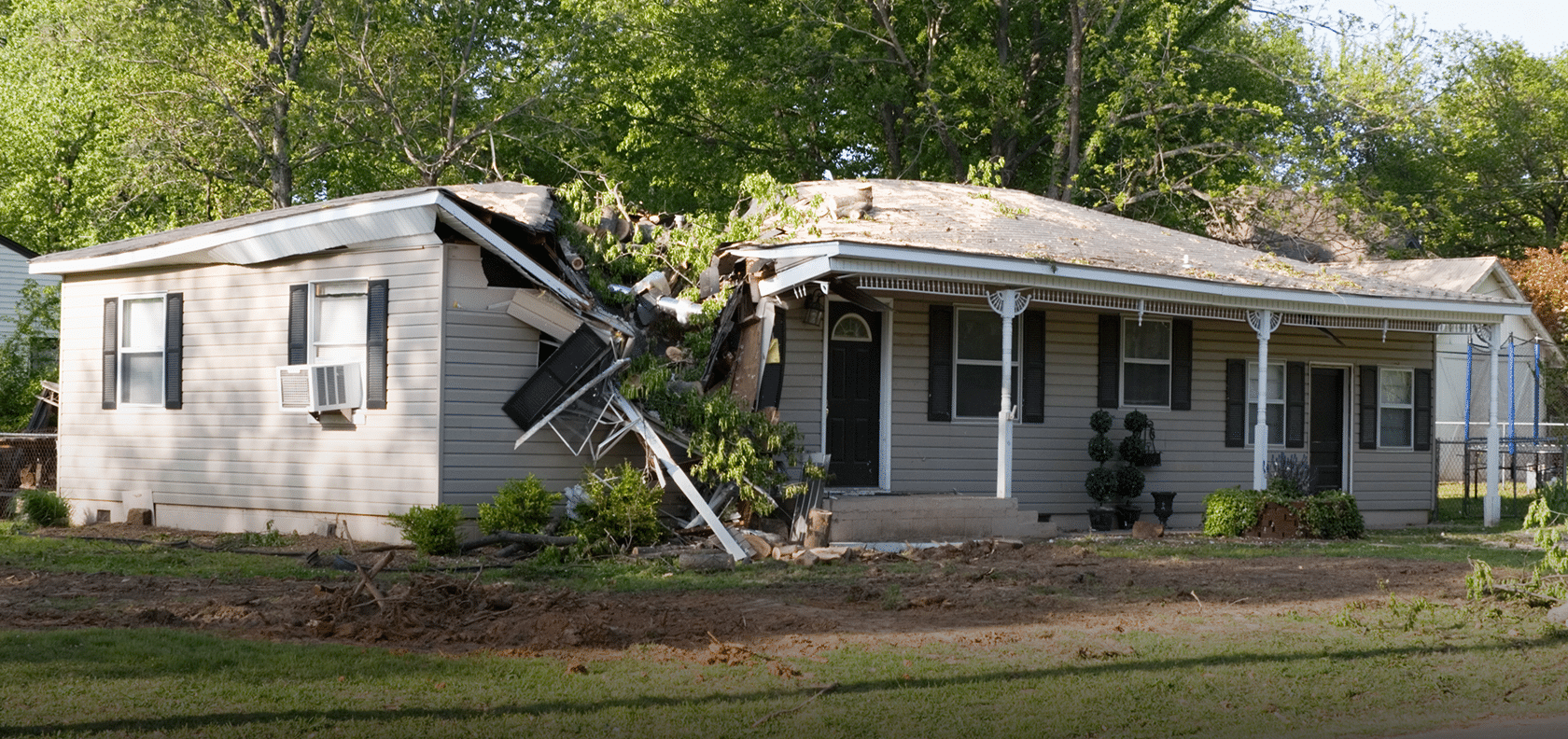

Homeowners insurance helps cover damage to both the interior and exterior of your home and offers protection if someone is injured on your property. While you might grasp the basics of your home policy, understanding how your home insurance deductible works in the event of a claim may be less clear.

A home insurance deductible is the amount you must pay out of pocket per claim before your insurance begins to cover damages or losses from an event. Deductibles vary by policy, generally ranging from $500 and above. Deductibles usually cover damage to your home (dwelling), other structures on your property, and your personal belongings (personal property).

Types of home insurance deductibles

Home insurance policies typically include two types of deductibles: standard and percentage.

Standard deductible: This is a fixed amount you pay out of pocket before your insurance takes over for the remaining costs of a covered loss.

Percentage deductible: Calculated as a percentage of your home’s insured value, this deductible is often applied for specific claims, such as wind, hail, or hurricane damage.

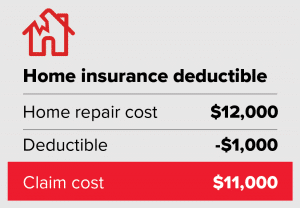

Example of a home insurance deductible

If you file an insurance claim after an incident, you may wonder how your deductible applies. For instance, if your home sustains $12,000 in damage and you have a $1,000 deductible with MAPFRE Insurance, you will pay the $1,000, and MAPFRE would cover the remaining $11,000.

Understanding your deductible

When you purchase your home policy, you select your deductible amount along with specific coverages and coverage limits. If you’re unsure what your deductible is, you can check the latest policy in your MAPFRE Customer Account or by reaching out to your independent agent for clarification.

Choosing a low or high deductible

Your choice of deductible amount will influence your yearly premium and your out-of-pocket expenses in the event of a claim.

Opting for a higher deductible typically lowers your annual premium. However, in case of a claim, you’ll be responsible for a greater out-of-pocket expense.

On the flip side, a lower deductible results in a higher annual premium, but your costs for repairs will be less if you need to file a claim.

When a home insurance deductible doesn’t apply

Deductibles commonly apply to property damage but do not pertain to the liability portion of a policy. For example, if you file a claim for:

- Personal Liability

- Medical Payments

- Loss of Use

Additionally, some endorsements, such as MAPFRE’s Valuable Possessions Coverage, or separate policies like flood or earthquake insurance, may not require a deductible.

For specific questions about your deductibles and policy details, or to get a home insurance quote, it’s best to contact your independent agent. If you’re not insured with MAPFRE and live in Massachusetts, consider getting a fast, free quote today!