From gas to food to clothing, consumers in the United States continue to feel the financial impact of rising inflation, supply chain issues, labor costs, extreme weather-related losses, and now tariffs. According to Bankrate, the average cost of homeowners insurance in 2025 was $2,400 annually for $300,000 in dwelling coverage.

By August 2025, the Consumer Price Index, which measures price changes for commonly purchased goods and services, indicated that the national inflation rate had risen to 2.9%.

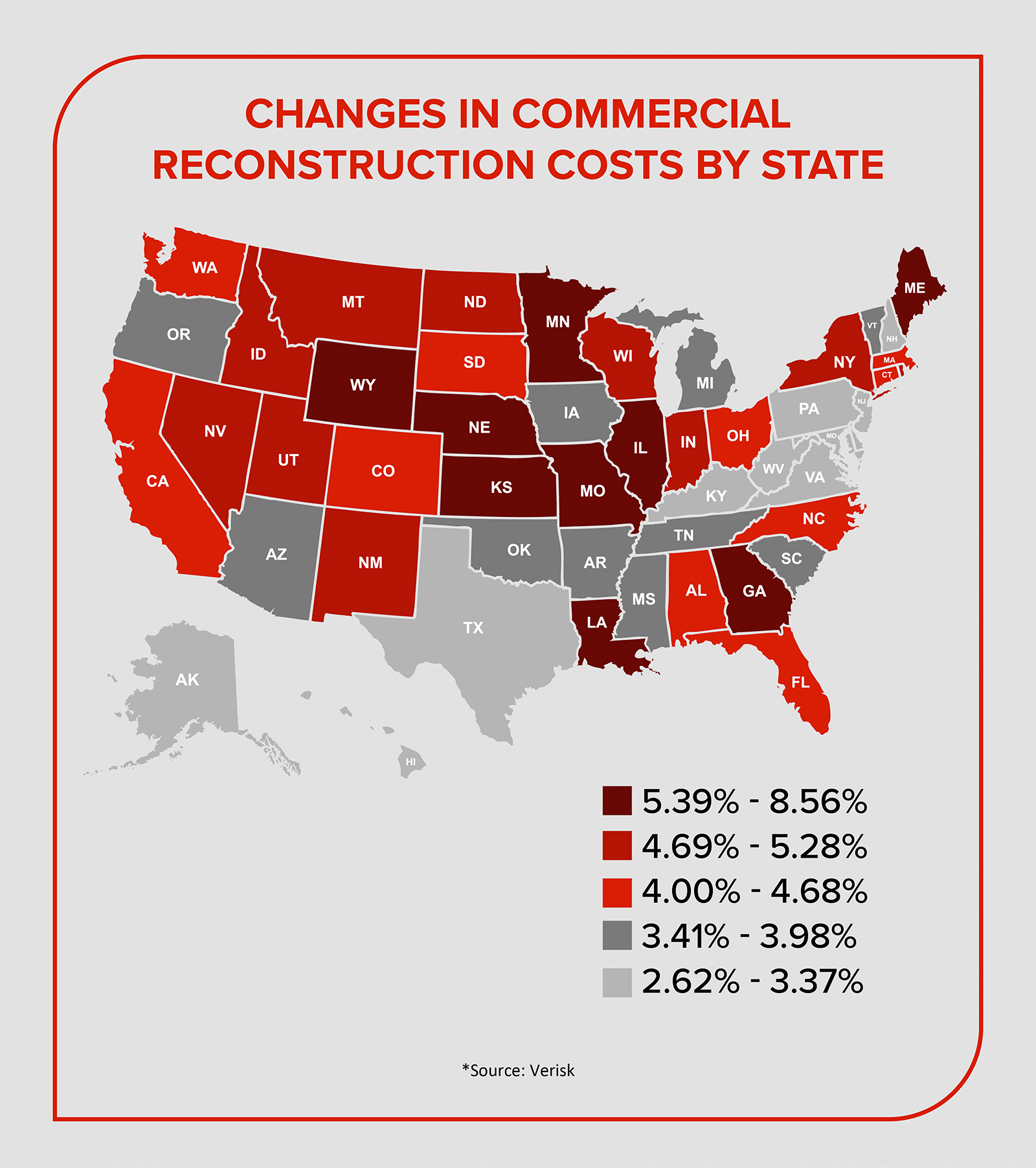

Additionally, a study conducted by Verisk from July 2024 to July 2025 reported a 4.2% increase in reconstruction costs across all states. This includes expenses related to materials and labor for home repairs and renovations. Although this is a slight decline from the 5.2% increase recorded in the previous period, some states are experiencing much higher increases. Kansas has the highest rate at 6.62%, followed closely by Minnesota and Georgia at 5.79%, and the District of Columbia at 5.78%.

Several factors beyond inflation and claims have contributed to the rise in home insurance rates. Key considerations include the age of your home, its estimated rebuilding cost, and the deductible amount. Additionally, the location of your house and its susceptibility to extreme weather events are significant factors affecting rising premiums. The increasing costs of building materials, a labor shortage, and higher insured losses from natural disasters, such as wildfires, hurricanes, tornadoes, and other storms, have all contributed to the rising costs.

If you’ve filed a home insurance claim, you may have encountered supply chain issues, even if you weren’t aware of it. This could mean longer waiting times for specific materials or a limited selection of available options, particularly affecting items like doors, shingles, or windows.

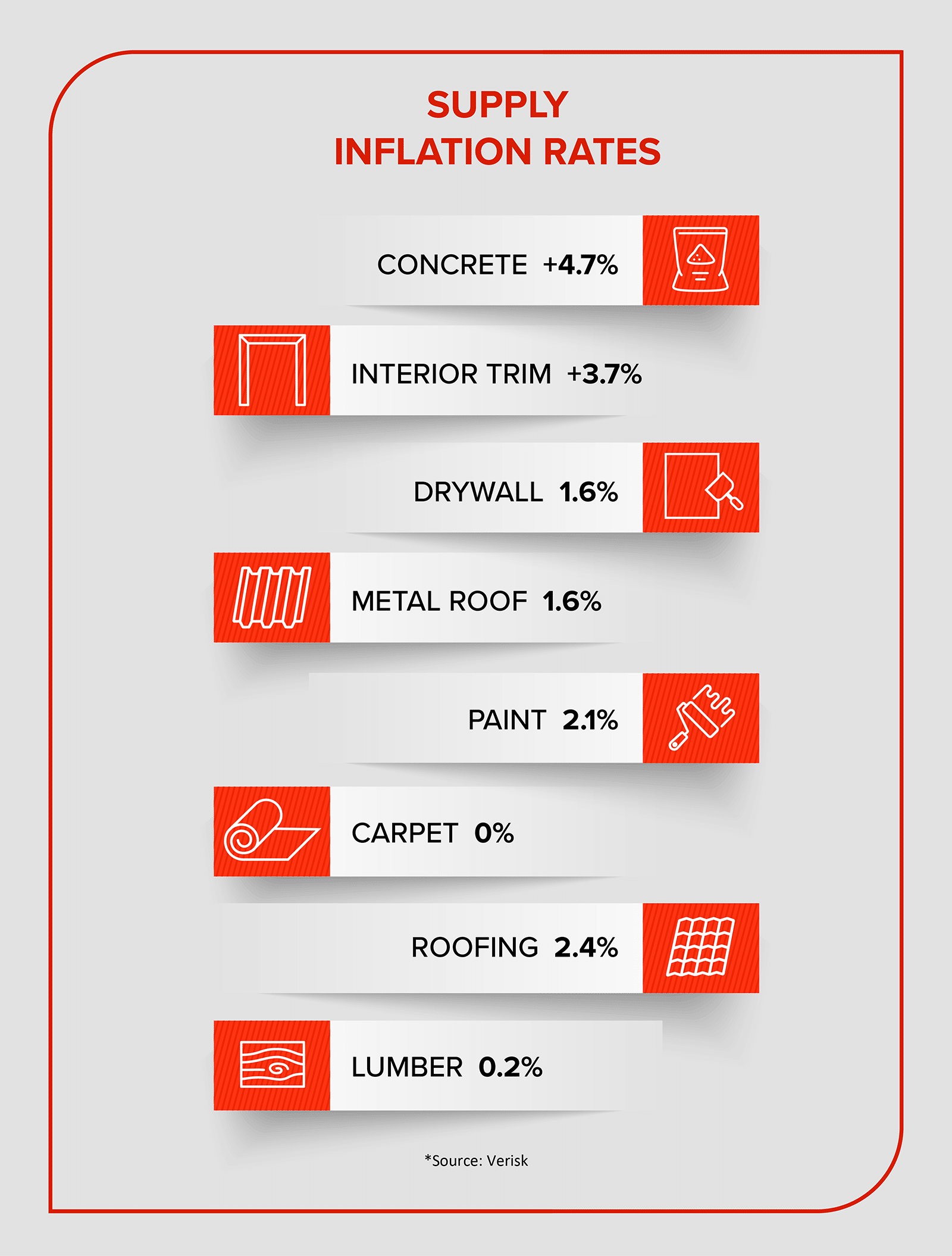

Although supply chain issues have eased somewhat, a study by Verisk reported that from July 2024 to July 2025, material costs increased by 2.81%. While carpet prices remained flat, lumber costs were relatively stable, with only a slight increase of 0.22%.

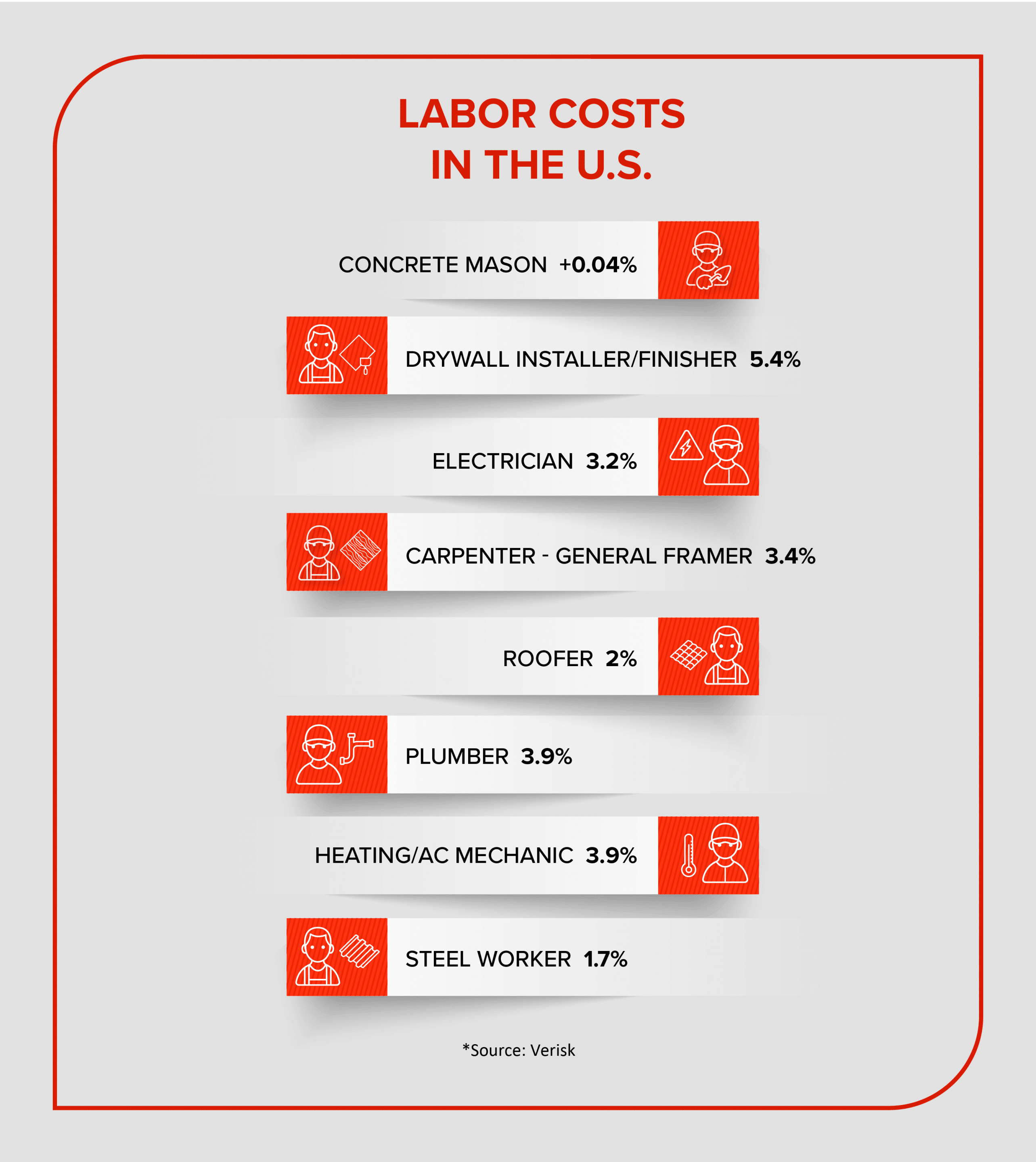

And as some materials are scarce, so are skilled workers. Verisk found that the growth of total costs outstripped the total inflation rate for the year at 4.1%. That was 3.2% the previous year. The residential and commercial labor costs grew for many fields of expertise, causing companies to pay higher rates for labor.

While MAPFRE Insurance cannot control many of these factors contributing to home repair delays or costs, we can help you through the steps you need to follow should you need to file a homeowner’s claim.

An option to help expedite your claims process is using MAPFRE’s ePICS® Program for Homeowners. The ePICS® Program is a self-service damage assessment option offered to customers who have a claim with limited damage, such as a broken fence or mailbox. Customers can submit photos and answer basic questions about their damage through the ePICS platform from any device. Once the damage is assessed, a check is issued to the customer within a matter of days in many cases.

For more extensive damage, MAPFRE offers a unique expedited home repair service called the Select Home Restoration ProgramSM that helps you get back to pre-loss conditions. With MAPFRE’s Select Home Restoration Program, the repair process is accelerated, and many of the services provided under the program are guaranteed. MAPFRE Insurance has partnered with “Select” restoration providers to deliver fast and high-quality home repair services.

These partners adhere to high professional standards, have excellent reputations, and provide superior customer service. When you’ve had unexpected damage to your property, your home restoration process should be quick and easy. While we cannot control some of the rising material costs due to inflation or delays due to supply chain issues, utilizing our Select Home Restoration Program can help streamline your homeowner’s claim process as much as possible.

Are you unsure what your home insurance policy covers, or do you need to add additional coverage? No problem! Your independent agent in your state can always review your policy with you to make sure you have the right coverage that suits your individualized needs.

And if you don’t have MAPFRE for your home insurance, you can get the right coverage for your property by calling an independent insurance agent in your state or, if you live in Massachusetts, by getting a fast, free quote today!