HIGHLIGHTS FROM THE FIRST NINE MONTHS

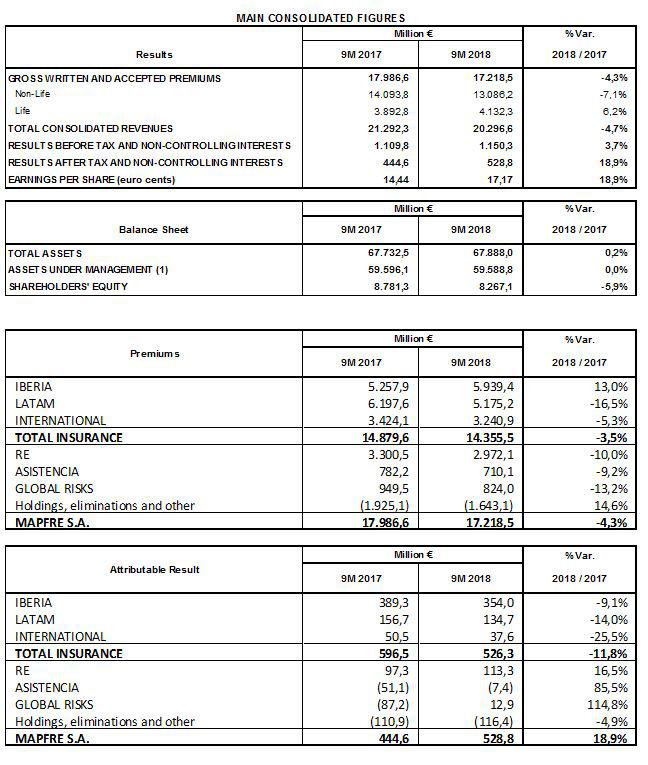

- Revenue amounts to 20.3 billion euros (-4.7 percent) while premiums total 17.22 billion euros (-4.3 percent). The change is down to the sharp currency depreciation across the main markets in which MAPFRE operates.

- Iberia is once again the Group’s main growth driver, posting premium growth of 13 percent and comfortably outperforming the market.

- MAPFRE RE continues to account for a significant portion of Group profits

- The combined ratio improves by almost one percentage point to 98.1 percent, with Spain, LATAM North, LATAM South and North America all performing well.

- ROE gains 2 points to stand at 9.2 percent.

- The company maintains the interim dividend at 6 euro cents per share, to be paid on December 20.

MAPFRE’s net earnings for the first nine months of the year amounted to 529 million euros, up 18.9 percent on the same period of the previous year, which was impacted by the exceptional catastrophic loss experience in the period. Meanwhile, revenue came to 20.3 billion euros (-4.7 percent) while premiums totaled 17.22 billion euros (-4.3 percent). MAPFRE has displayed impressive resilience and strength in weathering sharp currency depreciations across many of the main countries in which it operates (-24.5 percent in the case of the Turkish lira; -17.5 percent for the Brazilian real; -7.6 percent for the Mexican peso; -6.1 percent for the Peruvian sol; and -5.6 percent for the dollar, among others), coupled with a notable reduction in financial income due to the prevailing climate of low interest rates. On a constant currency basis, revenue and premiums would have grown by 1.2 percent and 2.2 percent, respectively.

Business in Spain remains the main growth driver for MAPFRE, while it is also important to highlight the contribution made to earnings by MAPFRE RE and the Regional Areas of LATAM North and LATAM South, along with the positive business performance of MAPFRE GLOBAL RISKS and MAPFRE ASISTENCIA.

The Group’s combined ratio improved by 0.7 percentage points to reach 98.1 percent, with strong performances from Spain (especially in the automobile, health and accident business), LATAM North, LATAM South and MAPFRE GLOBAL RISKS.

The solvency ratio at the end of June stood at 201.7 percent, with 93.3 percent in the form of high-quality capital (Tier 1), underpinned by high levels of diversification and strict investment and management policies.

Equity amounted to almost 9.8 billion euros, while shareholders’ equity totaled 8.27 billion euros at the end of September 2018. Total assets came to 67.89 billion euros.

Group investments at the close of the first nine months of the year totaled 49.88 billion euros, with 54.4 percent concentrated in sovereign debt and 18.7 percent in corporate fixed income. Meanwhile, 5.3 percent of total investment was in equities, 4.3 percent in real estate, 2.6 percent in mutual funds, 5.2 percent in cash and the remaining 9.5 percent in other investments.

1. Business performance:

Premium volume at the Insurance Unit for the first nine months of the year amounted to 14.36 billion euros (down 3.5 percent, principally in response to exchange rate fluctuations, as mentioned previously).

→ The Iberia Regional Area (Spain and Portugal) grew premium volume by 13 percent to 5.94 billion euros. Profits came to 354 million euros, while the combined ratio improved by 2 tenths of a percentage point to 93.8 percent.

Spain business volume outpaced the market, growing by 13.4 percent, bringing total premium volume to 5.84 billion euros, largely on the back of business growth in the Life segment (+26.9 percent). The Non-Life segment also posted significant growth of 7 percent, against average market growth of 4 percent. Premiums in the Automobile business amounted to 1.7 billion euros, revealing growth of 2.6 percent (3 tenths of a percentage point ahead of average market growth). Further highlights include the improvement of half a percentage point in the combined ratio – which stood at 90.7 percent – and the solid business performance of VERTI. At the close of September, MAPFRE insured a total of 5.7 million vehicles (142,000 more than in September 2017). Premiums from the general P&C line were up 12.3 percent to 1.43 billion euros, while premiums from Health and Accident grew by 5.7 percent to end September at 573 million euros, yielding a notable improvement in the combined ratio (-2.3 percentage points) to 97.3 percent.

Meanwhile, business at MAPFRE VIDA rose 27 percent to 2.02 billion euros. Though this significant increase was largely down to the issuing of a significant group Life policy, the business would still have posted positive growth of 9.3 percent (versus a one percentage point drop across the wider sector) after excluding this one-off impact. Mutual funds came to 3.48 billion euros (-4.9 percent), while pension funds grew by 2.8 percent to reach 5.07 billion euros.

→ Premiums in the Brazil Regional Area amounted to just under 3 billion euros at the end of September, down 13.4 percent due to the depreciation of the Brazilian real. Measured in local currency, premiums were up 5 percent on the back of the general P&C (+3 percent) and Life (+10 percent) businesses.

→ Revenue for the LATAM North Regional Area amounted to 983 million euros (-32.6 percent). This decline was down to the depreciation of the main currencies within the region and the effect of the PEMEX policy issued in 2017, which is multiyear and therefore provides an unreliable comparison. It should be noted that most countries in the region reported solid growth in local currency. Mexico –stripping out the PEMEX effect– was up 15 percent in local currency, while the Dominican Republic gained 13 percent, Honduras and El Salvador each added 8 percent and Nicaragua and Costa Rica grew by 7 percent and 21 percent respectively. A further highlight was the significant improvement in the combined ratio across the region, which improved 2.4 percentage points, standing at 96.6 percent, and earnings in Mexico were up fivefold to 16 million euros.

→ Premiums in the LATAM South Regional Area came to 1.21 billion euros (-6.5 percent). In local currency, however, virtually all countries posted growth: Peru (+14 percent), Paraguay (+6 percent), Uruguay (+10 percent) and Ecuador (+4 percent). The region recorded a notable improvement in its combined ratio, which fell by nearly 2 percentage points to 97 percent, aided by a significant reduction in costs.

→ The North America Regional Area ended the first nine months of the year with premium volume of 1.89 billion euros (-4.7 percent) and earnings roughly matching that reported in September 2017 (21 million euros), affected by the restructuring cost associated with the company’s withdrawal from certain states.

In the United States, premiums totaled 1.58 billion euros (-8.3 percent). Significantly, business was up 1.3 percent in local currency in Massachusetts and four neighboring states (the most important regions in the Northeastern United States), while in the other regions, business continued to decline due to the ongoing policy of improving profitability and canceling loss-making businesses. In Puerto Rico, premiums measured in local currency gained 26.2 percent to 310 million euros, yielding profit of 11 million euros and a combined ratio of 94.2 percent.

→ Premiums in the Eurasia Regional Area were down 6.3 percent to 1.36 billion euros, due to the depreciation of the region’s main currencies (Turkish lira, Philippine peso and Indonesian rupiah). In Turkey, premiums amounted to 360 million euros (-28.1 percent), a result of both the depreciating lira and the impact of regulatory changes on the Automobile insurance segment, which led to significant downward pricing pressure. Stripping out the currency effect, premiums in Turkey would have fallen by 4.8 percent. In Italy, premiums improved slightly, totaling 354 million euros (+0.4 percent), while in Malta and Germany, volume stood at 306 million euros (+9.8 percent) and 268 million euros (+3.8 percent) respectively.

Premiums at the Reinsurance Unit were down 10 percent to 2.97 billion euros at the close of September 2018, partly in response to a depreciating dollar (the main currency for this business). However, net earnings climbed 16.5 percent to reach 113 million euros, despite absorbing a net impact of 39 million euros in the quarter in the wake of Typhoon Jebi in Japan. MAPFRE RE’s combined ratio continued to impress, shedding a further 2.1 percentage points to reach 94.5 percent.

The Global Risks Business Unit reported premiums of 824 million euros (-13.2 percent), also impacted by the foreign currency effect. Significantly, this unit posted profits of 13 million euros, compared with losses of 87 million euros in September 2017, and has also made significant improvements to its combined ratio, which now stands at 95.7 percent.

Last but not least, revenue from the Assistance, Services and Specialty Risks Unit at the close of September 2018 totaled 765 million euros, down 11.9 percent, due to the continuation of the measures already in place to restructure the business and improve profitability. The unit therefore posted a loss of 7.4 million euros, compared with losses of 51 million euros a year earlier.

2. Dividend

The Board of Directors approved an interim dividend of 6 euro cents per share against 2018 earnings, which will be paid on December 20.

3. Appointment

The board of directors has appointed Antonio Gómez Ciria as an independent director via the co-option procedure, with effect from January 1 next. Antonio Gómez Ciria replaces Rafael Márquez Osorio, who is stepping down from his duties having served the maximum term in office set down in the board’s statutes.

Antonio Gómez Ciria holds a degree in Economics and Business Sciences and another in Pure Mathematics from the Universidad Complutense de Madrid, and also received an Executive MBA from IESE. Antonio has held numerous management positions in both FCC and InverCaixa and was previously president of the Institute of Accountants and Auditors.