The 2025 Atlantic hurricane season officially begins June 1, and this year, forecasters with the National Oceanic and Atmospheric Administration (NOAA) were predicting above-normal hurricane activity in the Atlantic basin. Forecasters predicted a 30% chance of a near-normal season, a 60% chance of an above-normal season, and a 10% chance of a below-normal season. The season runs from June 1 to November 30.

For the new season, NOAA forecasted 13 to 19 named storms (winds of 39 mph or higher). Of those storms, 6 to 10 were predicted to become hurricanes (winds of 74 mph or higher), with 4 to 5 potentially becoming major hurricanes.

Hurricanes can bring high winds, heavy rain, storm surge, and flooding, which can cause significant damage to your property. According to NOAA, the parts of the country that deal with the most hurricanes are the Gulf Coast states and the Atlantic Coast.

The World Meteorological Organization selected a list of names for the 2025 storms:

- Andrea

- Barry

- Chantal

- Dexter

- Erin

- Fernand

- Gabrielle

- Humberto

- Imelda

- Jerry

- Karen

- Lorenzo

- Melissa

- Nestor

- Olga

- Pablo

- Rebekah

- Sebastien

- Tanya

- Van

- Wendy

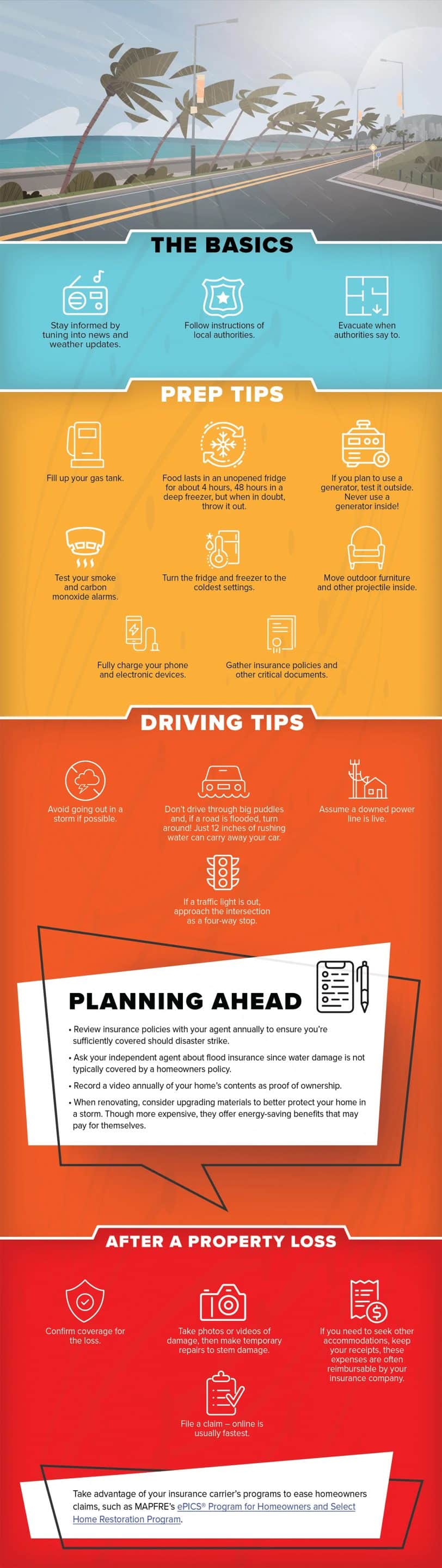

Not all storms make landfall, but ones that do can lead to more damage and potential flooding. That’s why it’s essential to prepare your home accordingly. The American Red Cross has several recommendations that can help you stay safe in the event of a storm:

Stay informed

- Monitor weather reports

- Sign up for free text and email alerts offered by your local community

- Have a battery-powered radio on hand

Stock up on supplies

- Gather food, water, medicine, and other supplies into a Go-Kit (3 days of supplies) and a Stay-at-Home Kit (2 weeks’ worth of supplies)

- Have backup batteries and chargers for your devices (cell phone, CPAP, wheelchair, etc.)

- Have a 1-month supply of medication in a child-proof container

- Turn your refrigerator and freezer to the coldest setting. Keep them closed as much as possible so that food will last longer if the power goes out

- Secure personal, financial, and medical records

Prepare electronic devices and appliances

- Keep electronic devices fully charged like cell phones, tablets, and laptops ahead of time in case the power goes out

- Unplug small appliances

Prepare the outside of your home

- Secure items outside, such as lawn furniture and trash cans, that could be picked up by high winds

- Anchor objects that would be unsafe to bring inside, such as gas grills and propane tanks

- Trim or remove trees close enough to fall on your home

- Protect windows with permanent storm shutters or pre-cut plywood

- Clean out drains, gutters, and downspouts

- Stockpile protective materials such as plastic sheeting and sandbags in the event of flooding

Know your evacuation route

- Fill up your gas tank

- Plan out your route

- Find out where the local shelters are

If you are ordered to evacuate by local authorities, leave your home immediately! If you are not in a mandatory evacuation zone or choose not to go, the Red Cross recommends you:

- Determine your best protection for high winds and flooding

- Take shelter in a designated storm shelter or an interior room for high winds

- Stay away from glass windows, skylights, and glass doors

- Move to higher ground before flooding begins

Preparing your family and your home is important, but you should also make sure you have the right type and amount of coverage on your property insurance policy well in advance of an impending storm. The Insurance Information Institute (III) recommends four key hurricane preparedness tips:

Review your insurance coverage

Review your insurance policy with your independent agent to see how much coverage you have, your deductibles, and how potential claims would be paid. You can review this information by reading the declarations page of your policy. Remember, if you don’t have flood insurance, you should probably consider it because it is a separate add-on to your homeowner’s insurance.

Flood insurance can be obtained through FEMA’s National Flood Insurance Program and by contacting your independent agent.

Protect your vehicles

Ensuring you have Comprehensive Coverage, which is optional, will protect your vehicle against theft and damage caused by an incident other than a collision. This includes fire, flood, hail, falling rocks or trees, and vandalism.

Protect your possessions

Your homeowner’s policy does protect against loss or damage to personal property due to a hurricane. However, it would help if you had a general plan to repurchase things like furniture, electronics, clothing, and other personal items. III recommends you create an inventory of your belongings and their value to ensure that you are adequately insured for either the replacement cost or the actual cash value

Make your property more resilient

III recommends investing in items to protect your property against wind damage, like roof tie-downs, a wind-rated garage door, and storm shutters. It would help to consider having your roof inspected annually to ensure it can withstand high winds and heavy rain.

Should you need to file a claim due to any kind of storm damage, you can start the process online or by calling MAPFRE directly on our 24-hour claim reporting line at 1-800-221-1605. You can also contact your independent agent.