Whether you notice it when you first get in the car, or if it happens when you are driving, having a chipped, cracked, or damaged windshield can be a surprising and frustrating experience.

Driving with any size chip or crack can compromise the safety of your windshield and impair your vision. Some states also have laws against driving with a cracked or damage windshield. It’s a good idea to get the damage fixed before it becomes a bigger problem. You also don’t want damage to become so severe that your windshield is not repairable.

Did you know with minor chips and cracks you could get your windshield repaired and not have to get it fully replaced?

A repair, if safe to do so, also preserves the factory calibrated advanced safety systems settings of the camera connected to your windshield.

So, just when should your windshield be repaired or completely replaced?

Windshield repair and windshield replacement

Depending on the size, location, and severity of the damage, windshields can sometimes be repaired with the injection of a specialized resin into the chip or crack. With Safelite®, a windshield can usually be repaired if:

- The glass is tempered and not laminated.

- The damage is under 6 inches in length.

- The point of impact is smaller than a dime.

- There are no more than three chips.

- The damage doesn’t block a camera or sensor.

Should the windshield not meet the above criteria, it would need to be completely replaced.

Camera recalibration

Because newer vehicles have advanced safety systems that use data from a camera connected to the front windshield, having the camera recalibrated is necessary after a windshield replacement. Vehicle manufacturers require camera recalibration after a replacement so that the vehicle’s safety systems, like automatic emergency braking, lane assist, and forward collision warning, continue to work correctly. Not calibrating a windshield could adversely affect the vehicle’s factory safety settings.

How much does it cost to repair or replace a windshield?

A small windshield repair could cost a couple hundred dollars, while a full windshield replacement could cost $1,000 or more, depending on the make and model of the vehicle. When you are insured with MAPFRE, comprehensive coverage will take care of the cost to repair or replace the windshield, and there is no deductible. If you do not have comprehensive coverage and only have a small chip or crack the cost would be out of pocket to repair, it which would be much less expensive than a full windshield replacement. Windshield damage as a result of a collision would be covered under your collision coverage and would be subject to the deductible you chose on your car insurance policy if you were at fault in the accident or if the other vehicle is unknown.

How to file an auto glass claim

Should you need to get your windshield repaired or replaced due to a chip or crack, rest assured, MAPFRE has streamlined the repair process for you.

The process to get the damage taken care of can be done in four easy steps with glass repair shops nationwide:

- Step 1: Report Windshield/Auto Glass Claim

- Step 2: Select Preferred Glass Shop Facility

- Step 3: Repair

- Step 4: Completion

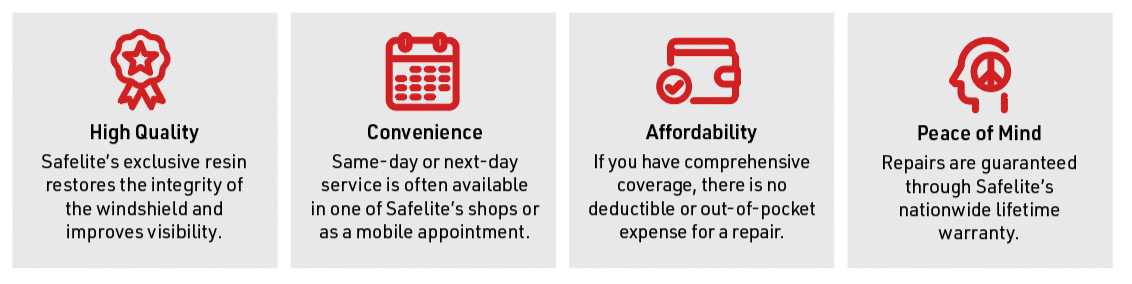

When MAPFRE customers choose Safelite for repair, they can expect:

If you still have questions on how to file an auto glass claim, your independent agent can help walk you through the process as well as make sure you have the right coverage to suit your individualized needs. Not a MAPFRE customer yet? Contact an independent agent in your state or get a fast, free car insurance quote in Massachusetts today!