When it comes to auto insurance, having a solid understanding of your policy is essential. MAPFRE auto insurance policies provide the protection you need and offer additional coverages backed by service designed for your peace of mind. One crucial aspect of your policy that can often be misunderstood is your car insurance deductible.

What is a car insurance deductible?

Simply put, a car insurance deductible is the amount you will pay out of pocket for a claim before your insurance coverage kicks in. It acts as a threshold—once your claim surpasses this amount, your insurer will start paying for the damages or losses incurred from an accident.

They primarily apply to comprehensive and collision coverage, limited collision, and glass deductibles. Additionally, they may pertain to specific state protections, such as Personal Injury Protection (PIP) in Massachusetts.

Example of a car insurance deductible

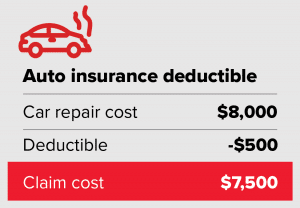

You may wonder how your deductible would apply if you had to file a claim. For instance, if your vehicle sustained $8,000 worth of damage and you have a $500 deductible, you would be responsible for the first $500. MAPFRE would then cover the remaining $7,500.

How to find out your deductible

When you initially purchased your auto policy, you selected your deductible amount along with specific coverages and their limits. If you’re unsure about your current deductible or want to verify it, you can check your latest policy in your MAPFRE Customer Account or call your independent agent for assistance.

Choosing between a low or high deductible

Making the choice between a low or high deductible is crucial as it can impact both your premium and any out-of-pocket expenses you may incur in the event of a claim.

High Deductible: Opting for a higher deductible can lower your annual premium. This choice means that if you do file a claim, MAPFRE won’t pay out as much, which could be beneficial if you have a solid driving record with few claims.

Low Deductible: On the other hand, selecting a lower deductible typically results in a higher annual premium but reduces your out-of-pocket repair costs in case you need to file a claim.

When you don’t have to pay a deductible

While certain states require a deductible on specific coverage options, the application and amounts can vary based on your policy.

There are also situations in which you might not need to pay a deductible at all, including:

- If the damages to your vehicle are below your deductible amount, you would need to pay for those repairs out of pocket.

- If you are not at fault in an accident and the other driver’s insurance is responsible for the damages.

- If an operator covered under your policy has a clean driving record and is involved in an accident while under Collision or Limited Collision coverage, the deductible will be waived up to a maximum of $500.

- If your policy includes a Waiver of Deductible.

Lastly, ensure your MAPFRE auto insurance and home policies are always up to date by contacting an independent agent in your state. If you’re not insured with MAPFRE yet and live in Massachusetts, you can get a fast, free quote online today!